Power surges happen when the voltage running through your home’s electrical system unexpectedly spikes to a level beyond what your electronic appliances are designed to handle. Depending on the strength of the surge, this could mean minor damage or complete destruction of your valuable electronics (PS4 or Xbox).

Power surges happen when the voltage running through your home’s electrical system unexpectedly spikes to a level beyond what your electronic appliances are designed to handle. Depending on the strength of the surge, this could mean minor damage or complete destruction of your valuable electronics (PS4 or Xbox).

There are typically three causes of a power surge: lightning strikes, downed power lines, and large home appliances. While power surges are sometimes unavoidable, there are some precautions you can take to help prevent these costly damages.

- Use surge protectors. Surge protectors come in a variety of styles. When shopping for a surge protector, check the device’s clamping voltage. This is the level at which it will begin to block the surge.

- Install specialized outlets. Purchasing specialized outlets that offer surge protection is a good option for areas in your home where a normal surge protector would not fit. For example, surge protection outlets can be used in the kitchen for things like microwaves and electric stoves.

- When in doubt, unplug. Lightning storms can overwhelm even the best surge protectors. In the event of a powerful storm, unplugging valuable electronics from your outlets can save them from potential surges.

- Use a service entrance surge protector. A service entrance surge protection device can provide protection for your incoming electrical, cable TV, and telephone lines. the device is installed in your main electrical panel or near your electric metre to help stop outside surges from entering your home.

After a power surge, your surge protector could be damaged. Contact the manufacturer if you believe that your surge protector may be damaged. They can help you test or replace your device.

Contact Scrivens today to discuss potential coverage options for your personal property to ensure that you are covered in the event of a surge.

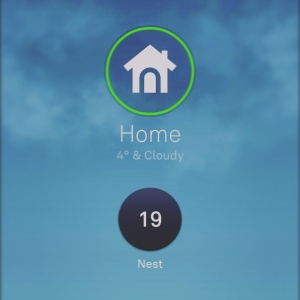

As technology continues to advance, more and more aspects of the home are becoming automated. When a home is outfitted with an array of these electronic systems, it is often referred to as a “smart” home.

As technology continues to advance, more and more aspects of the home are becoming automated. When a home is outfitted with an array of these electronic systems, it is often referred to as a “smart” home.

A

A  Creating an inventory of your belongings may seem like a hassle, but it’s crucial when it comes to saving you time and money when filing an insurance claim. A home inventory is essentially a detailed list of all of the valuables in your home and generally includes a description, serial number (if applicable), the purchase date, and estimated value of each item. In the event of a natural disaster or home break-in, an up-to-date inventory can help expedite the claims process and verify your losses.

Creating an inventory of your belongings may seem like a hassle, but it’s crucial when it comes to saving you time and money when filing an insurance claim. A home inventory is essentially a detailed list of all of the valuables in your home and generally includes a description, serial number (if applicable), the purchase date, and estimated value of each item. In the event of a natural disaster or home break-in, an up-to-date inventory can help expedite the claims process and verify your losses. When determining your insurance coverage options there is an important distinction to note: market value or replacement cost.

When determining your insurance coverage options there is an important distinction to note: market value or replacement cost. According to the

According to the